AI For Business: Top 10 AI Tools For Business in 2025

Written by KRITIKA SINHA | MARKETING Are you feeling the relentless pressure of a rapidly evolving market, where traditional methods struggle to keep pace with escalating demands for efficiency and innovation? Are your teams bogged down by repetitive tasks, struggling to extract ...

- All

- Awards30

- Cloud Services49

- Cyber Security170

- IT Consultancy39

- IT Procurement12

- Managed IT Services166

- Software Development42

- Sustainability9

- All

- Awards30

- Cloud Services49

- Cyber Security170

- IT Consultancy39

- IT Procurement12

- Managed IT Services166

- Software Development42

- Sustainability9

10 Signs You Need to Upgrade Your IT Support

Written by KRITIKA SINHA | MARKETING “Why does my team spend more time fixing tech issues than serving clients?”“Are we losing business because our systems keep crashing?”“How ...

Managed Cyber Security Service: How Small Businesses Can Stay Safe

Written by KRITIKA SINHA | MARKETING A single phishing email, a forgotten software update, or an unnoticed network vulnerability—these are all it takes for a small business ...

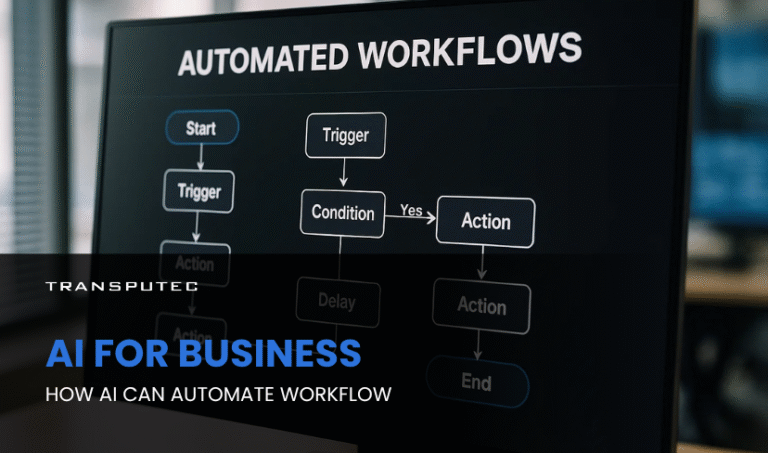

AI For Business: How AI Can Automate Workflow

Written by KRITIKA SINHA | MARKETING Picture this: your top sales executive spends more time updating CRM records than closing deals. Your finance team is drowning in ...

Co-Managed IT vs Fully Outsourced IT: Which One Is Right for You

Written by KRITIKA SINHA | MARKETING Technology issues can cripple business operations. IT downtime, cybersecurity threats, and lack of technical expertise often lead to financial losses, frustrated ...

Custom AI: How To Access AI That’s Tailored To Your Business

Written by KRITIKA SINHA | MARKETING Every business leader knows the frustration of wasted hours on repetitive tasks, missed opportunities buried in data, and the relentless pressure ...

How Business Automation Transforms Efficiency & Growth

Written by KRITIKA SINHA | MARKETING Your team spends hours every week on repetitive tasks: data entry, invoice chasing, endless spreadsheet updates. Deadlines get tighter, errors creep ...

Why SMEs Need SOC as a Service

Written by KRITIKA SINHA | MARKETING A small business is attacked every 39 seconds in the UK alone, yet most SMEs believe they’re too small to be ...

AI in Cybersecurity: How Intelligent Systems are Defending Against Advanced Threats

Written by KRITIKA SINHA | MARKETING Your firewall wasn’t fast enough. The malware had already breached your system before your IT team even had time to blink. ...

SOC 2 Compliance: What UK Businesses Need to Know

Written by KRITIKA SINHA | MARKETING Security breaches don’t just cost money—they destroy trust, disrupt business, and can even end careers. Imagine a single phishing email leading ...

Why Proactive Managed IT Services are Essential for UK SMEs

Written by KRITIKA SINHA | MARKETING Every business owner knows the feeling: the phone rings, and suddenly, your team is locked out of the system. Files are ...

Secure Your Hybrid Workforce: How Microsoft Modern Workplace Protects Your Data

Written by KRITIKA SINHA | MARKETING Imagine this: a team scattered across time zones, working from airports, coffee shops, home offices—and your organisation’s most sensitive data travelling ...

How Microsoft Modern Workplace Supports SMEs

Written by KRITIKA SINHA | MARKETING Imagine a Monday morning where your team is scattered—some in the office, others at home, a few on-site with clients. Files ...

Everything You Need to Know About Microsoft Modern Workplace

Written by KRITIKA SINHA | MARKETING Do you often struggle with messy communication, separate bits of information, and a team finding it hard to work together in ...

10 Signs Your Business Needs Better Mac IT Support

Written by KRITIKA SINHA | MARKETING Tired of Recurring Mac Issues Slowing Down Your Team? Here’s What You’re Missing If your employees regularly complain about sluggish Macs, ...

Enhancing SOC as a Service Efficiency through AI

Written by KRITIKA SINHA | MARKETING Imagine this: a business rolls out new services, focuses on innovation, and invests in growth, only to find its network quietly ...

Why Managers Are Turning to Co-Managed IT

Written by KRITIKA SINHA | MARKETING Every manager knows the feeling: the IT team is swamped, critical tickets are piling up, and new projects keep getting delayed ...

Smishing: How Fake Texts Can Trick Your Team

Written by KRITIKA SINHA | MARKETING Your Team Might Be Texting with a Cybercriminal It starts with a beep. A team member checks their phone and sees ...

Should You Invest in Agentic AI? What IT Managers Need to Know

Written by KRITIKA SINHA | MARKETING Every day, IT managers and business owners face a relentless barrage of challenges: mounting workloads, evolving cyber threats, and the constant ...

AI and Digital Transformation: How Can It Change Your Business

Written by KRITIKA SINHA | MARKETING Imagine a business owner staring at a dashboard of outdated data, struggling to make sense of market shifts, while employees waste ...

How AI Is Transforming Corporate Training and Educational Platforms

Written by KRITIKA SINHA | MARKETING Deadlines slip. Skills lag. Employee engagement drops. It’s a familiar struggle for HR teams and business leaders. Despite investing in learning ...